Risk Management and Covenant Testing in Lagos Real Estate Finance

Introduction

In prime Lagos development and income assets, risk is not eliminated — it is structured, monitored, and priced. Serious capital wants three things before it moves: a covenant package that measures real risk, reporting that surfaces stress early, and remedies that work without collapsing the project. When those elements align, lenders underwrite with confidence, sponsors maintain control, and assets remain bankable across cycles.

Our framework is simple. First, design covenants that track what actually drives default: cash available for debt service, interest cover, loan-to-value, pre-sales quality, and cost-to-complete — tested against objective, auditable data sets. Second, install a monitoring cadence that ties board governance to lender requirements: independent QS certification, monthly cash reporting, variance flags, and sensitivity runs that show the effect of rate moves, cost creep, or delays. Third, embed cure mechanics that preserve momentum: cash sweeps and equity cures with clear timetables, step-in rights that keep the programme moving, and waiver protocols that protect the integrity of the documents.

In Lagos, two local features matter. On the regulatory side, planning and building-control compliance must stay in lockstep with the finance timetable. Inside Eko Atlantic, estate approvals, technical no-objection certificates, and recognition of lender step-in need to be visible in the covenant pack so credit committees can size risk without guesswork. Paired with international standards for credit-risk management and board oversight, this approach converts legal structure into practical protection.

By the end of this article, we will set out how we build covenant packages that reflect on-the-ground realities in Ikoyi, VI, and Eko Atlantic; how we monitor them without drowning stakeholders in noise; and how we execute remedies that keep projects financeable even when conditions tighten.

Designing the covenant pack (DSCR, ICR, LTV, pre-sales, cost-to-complete)

We design covenants to track the variables that actually drive default in Lagos development and income assets. The objective is not to over-engineer the loan agreement, but to measure cash, value, and progress with ratios that are auditable, comparable, and difficult to game.

Debt Service Coverage Ratio (DSCR).

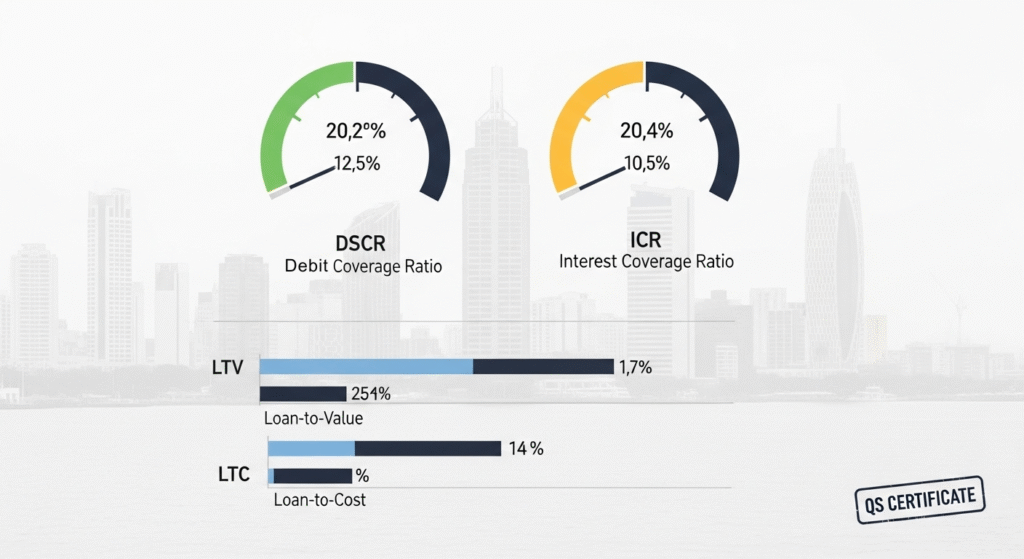

For stabilized income assets, we size and test on DSCR = Net Operating Income ÷ Total Debt Service (interest + amortization). We anchor base covenants on forward twelve-month projections with an independent valuation of sustainable NOI, then add a backward-looking maintenance test once the asset is operating. Where income is denominated in naira and debt in dollars, we formalize FX haircuts so DSCR does not give a false signal.

Interest Coverage Ratio (ICR).

During lease-up or where amortization is back-ended, ICR isolates interest risk: ICR = EBITDA (or NOI, by agreement) ÷ Cash Interest. In practice, we require both DSCR and ICR, because an ICR-only regime can disguise amortization cliffs and a DSCR-only regime can mask rising interest costs during delays.

Loan-to-Value and Loan-to-Cost (LTV/LTC).

For development, we use LTC during construction (debt ÷ total budgeted cost, independently verified) and switch to LTV at practical completion (debt ÷ market value on a RICS-compliant basis). Revaluations are time-boxed and methodology-locked to avoid “appraisal shopping.” If revenue is largely FX-linked, we stipulate valuation inputs and currency translation rules to keep LTV comparable across periods.

Pre-sales quality test (for residential and mixed-use).

Reservations are not the metric; bankable contracts are. We define qualifying pre-sales as (i) exchanged contracts with deposits in escrow, (ii) buyers passing KYC/AML screens, and (iii) mortgage-backed purchasers holding bank offer letters within validity. We cap exposure to any single buyer pool, track weighted-average price versus list, and exclude bulk sales below an agreed threshold from counting toward the covenant.

Cost-to-complete and liquidity tests (for development).

The project is financeable only while undrawn debt plus cash equity ≥ independent QS-certified cost to complete + contingency. We require monthly QS certificates, vendor-backed contingencies for long-lead items, and evidence that any cost creep is matched by committed funding before drawdowns continue. Where delays are outside contractor control (e.g., utility interface or estate approvals), we allow targeted timeline flex only if the liquidity test still passes.

Covenant architecture.

We separate information undertakings (what must be reported and when) from maintenance tests (what must be true each period) and incurrence tests (what must be true before new liabilities, distributions, or asset sales). Triggers are triangulated: one cash metric (DSCR/ICR), one balance-sheet metric (LTV/LTC), and one delivery metric (pre-sales or cost-to-complete). That mix gives lenders early signal without forcing unnecessary waivers and gives sponsors clear, objective rails to operate within.

Why this works in Lagos.

Ratios are only as credible as the evidence beneath them. We therefore hard-wire source documents: audited rent rolls and SNDA language for income, escrow statements and bank offer letters for pre-sales, QS certificates for cost, and RICS-standard reports for value. Inside Eko Atlantic, estate technical NOCs and recognition of lender step-in are listed as standing exhibits so committee reviews can rely on a complete, repeatable pack.

Monitoring that matters: reporting cadence, QS certification, and early-warning analytics

Cadence that keeps everyone aligned

We set a simple rhythm that boards, lenders, and contractors can keep without noise: weekly site progress notes, monthly management accounts with cash-flow forecasts, and a quarterly compliance pack. The monthly pack includes DSCR and ICR snapshots, a 13-week liquidity forecast, variance analysis against budget, and a traffic-light dashboard for covenants. For development assets, we add an updated cost-to-complete schedule and a presales roll showing exchange, deposits in escrow, mortgage status, and expiries. For income assets, we track WALE, arrears ageing, and lease events six to twelve months ahead so refinancing and re-letting are planned, not reactive.

Independent QS as the single source of truth

Progress and cost are certified by an independent quantity surveyor who is engaged to report to the board and the lender. Each certificate confirms percentage completion by trade, remaining cost to complete, contingency health, and exposure on long-lead items. Certificates tie directly to draw requests and escrow release conditions, which removes debate about whether a stage is fundable. When cost creep appears, the QS issues an exceptions note that quantifies the delta and recommends either scope control, procurement switch, or an equity top-up before the next draw.

Data integrity and audit trail

We standardise templates across projects: rent rolls, presales schedules, escrow statements, QS certificates, and covenant dashboards use the same fields. Each figure is traceable to a primary document. Buyer deposits, bank disbursements, and contractor payments are tagged to unit IDs or work packages so any reviewer can follow the cash. This keeps board decisions defensible and speeds lender reviews.

Early-warning analytics that are actually predictive

We watch a short list of leading indicators that move before covenants break:

- Two-period deterioration in the 13-week cash forecast without an identified cure.

- Cost-to-complete rising faster than certified progress.

- Presales conversion slipping below the underwriting matrix, or mortgage offer validity windows approaching expiry.

- For income assets, a drop in WALE below policy, arrears crossing a defined threshold, or concentrated tenant risk above agreed limits.

- Programme float consumed on critical path activities such as utilities interface or façade.

When a trigger fires, the board sees a written plan within the next cycle. The plan is specific: reduce scope, re-sequence works, activate a cash sweep, draw contingency, raise equity, or agree a waiver window with time-bound conditions.

Governance as a monitoring tool

We align board calendars with drawdowns and covenant test dates so decisions precede deadlines. The lender sits in as an observer for key meetings. Reserved matters require current dashboards and QS certificates in the board pack, which prevents undocumented variations and keeps the project within its risk envelope.

Cures and continuity: equity cures, cash sweeps, step-in rights, and waiver discipline

Set the cure hierarchy early

We document a clear order of operations so a wobble does not become a default. First, tighten spend and re-sequence works. Second, apply cash sweeps and lock distributions. Third, inject equity within a defined window. Fourth, step in to replace a non-performing contractor or manager. Only after these paths are tried, or time expires, do enforcement rights switch on.

Equity cures that actually reset ratios

An equity cure should be objective and fast. We define the cure window, the minimum amount, where the funds sit, and what ratios must be restored. Cured cash stays on balance sheet to support DSCR or cost-to-complete and cannot be distributed until covenants hold for at least one full test period. Documentation includes a board resolution, proof of funds, and an amended cash-flow that shows headroom after the cure.

Cash sweeps and hard locks

When DSCR or ICR falls below thresholds, the waterfall diverts free cash to required reserves and debt service. We use automatic sweeps to replenish the DSRA, retire past-due interest, and build a temporary liquidity buffer. Distributions pause until tests pass for two consecutive periods, or until an agreed cure plan is delivered and verified.

Step-in that preserves momentum

Continuity matters more than blame. Intercreditor and recognition agreements allow the lender, or the non-defaulting sponsor, to appoint a replacement contractor or operator, call performance bonds, and keep the programme moving without collapsing the JV. For income assets, SNDA language protects the rent roll. Tenants continue under existing leases if they perform, and the lender is recognised as landlord after enforcement. Inside Eko Atlantic, developer recognition and estate no-objection letters confirm that step-in will be honoured at the estate level.

Waiver discipline

A waiver is not a favour, it is a contract with conditions. We require a written request, a root-cause note, and a dated cure plan. Any waiver is time-boxed, non-precedential, and paired with consideration, for example extra reporting, additional collateral, or a temporary sweep. If milestones slip, the waiver falls away automatically.

Standstill and forbearance

Where immediate enforcement would destroy value, a short standstill can preserve options. The standstill covers no new indebtedness, no disposals outside the budget, weekly QS and cash reporting, and pre-agreed triggers that end the pause. This approach keeps the asset financeable while parties finish the cure.

Enforcement as a last resort

If remedies fail, enforcement proceeds in a way that protects market value. We agree valuations, notice periods, and sales protocols up front. Replacement of management or a pre-packaged sale is preferred to a fire sale. Every step leaves an audit trail so the outcome withstands review.

Governance keeps cures credible

Board calendars track covenant dates. Packs include DSCR and ICR snapshots, cash forecasts, QS certificates, and a one-page action log. The lender attends as observer for cure decisions. This rhythm keeps everyone aligned and reduces the need for emergency meetings.

Conclusion

Risk doesn’t disappear in Lagos real estate; it is converted into rules, evidence, and remedies. A covenant pack that tracks cash, value, and delivery (DSCR/ICR, LTV/LTC, pre-sales, cost-to-complete), paired with a reporting cadence anchored by independent QS certification, gives lenders and boards the same view of reality. When stress appears, a pre-agreed cure ladder — spend control, cash sweeps, equity cures, step-in, and time-boxed waivers — preserves momentum without eroding creditor protections. Inside Eko Atlantic, adding estate recognitions and technical NOCs to the standing exhibits keeps step-in and enforcement practical, not theoretical.

Our operating cadence remains consistent: design covenants around how the asset actually fails; monitor with documents that auditors can trace; execute cures that restore ratios within defined windows. The outcome is lower execution risk, cleaner refinancing paths, and assets that stay bankable across cycles.