Mortgage-Backed Absorption in Lagos: Turning Pre-Sales Into Bankable Occupancy

Introduction

In prime Lagos markets, revenue is only real when it converts to keys in hand. Pre-sales create momentum, but absorption is secured when qualified buyers pass underwriting, mortgages fund on schedule, and handovers occur without slippage. That requires more than marketing. It requires a sales programme that is engineered around lender policy, a pricing grid that matches eligibility bands, and documentation that survives committee and audit.

Our approach treats absorption as a finance problem first, and a sales problem second. We build a mortgage rail before launch, agree the underwriting “box” with partner banks, and design unit mix and price points to fall inside those thresholds. Reservation forms collect the documents credit officers will request later, so pre-qualification is fast and rework is minimal. On the project side, escrow, progress certificates, and clear milestone definitions allow banks to release funds with confidence. In districts such as Eko Atlantic, we add estate compliance and recognition documents so that mortgage security remains enforceable from draw to discharge.

This article sets out a practical framework for mortgage-backed absorption in Lagos: how to align product with bank policy, how to structure the finance rail so approvals convert, and how to run completion so funded buyers become residents on time.

Designing for eligibility: unit mix, price bands, and documentation that fit bank underwriting

Mortgage-backed absorption starts by fitting the product to the bank’s “box.” In Lagos, that box is defined by four variables: maximum loan size and tenure, the equity requirement, debt service capacity, and title enforceability. We design unit mix and pricing so that most reservations can pass credit without rework.

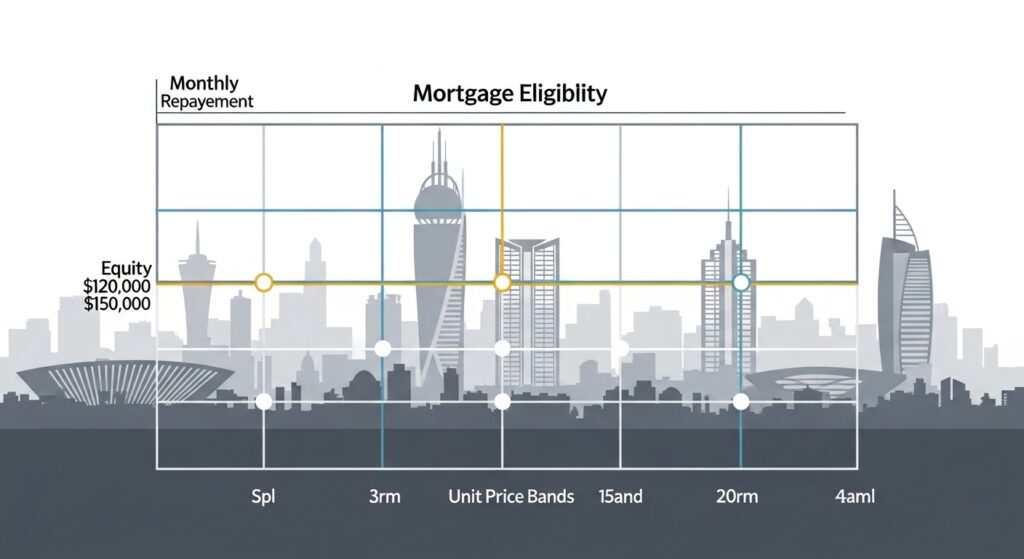

Align unit mix to affordability bands

Before launch, we map salary bands for target buyers and reverse engineer price points. The grid includes total price, equity contribution, loan amount, and the monthly repayment that falls within a conservative debt service ratio. We then calibrate a spread of unit types that sit inside those bands. In practice, this means avoiding a collection of beautiful outliers and delivering a balanced “ladder” of units that a partner bank can actually approve. Where a bank program caps property value or limits tenure by borrower age, we reflect that in the mix from day one.

Price for real approvals, not headlines

A credible price list anticipates the bank’s equity and LTV posture. National Housing Fund mortgages, delivered through Primary Mortgage Banks, typically offer fixed rates near 6 percent with long tenors up to 30 years and high loan-to-value ratios for eligible contributors. Commercial home loans from top banks often require at least 10 percent equity, use borrower age to cap tenure, and apply property value limits for certain products. We build bands that respect these rules and we publish a parallel “mortgage matrix” to sales teams so customers are guided to units they can truly fund.

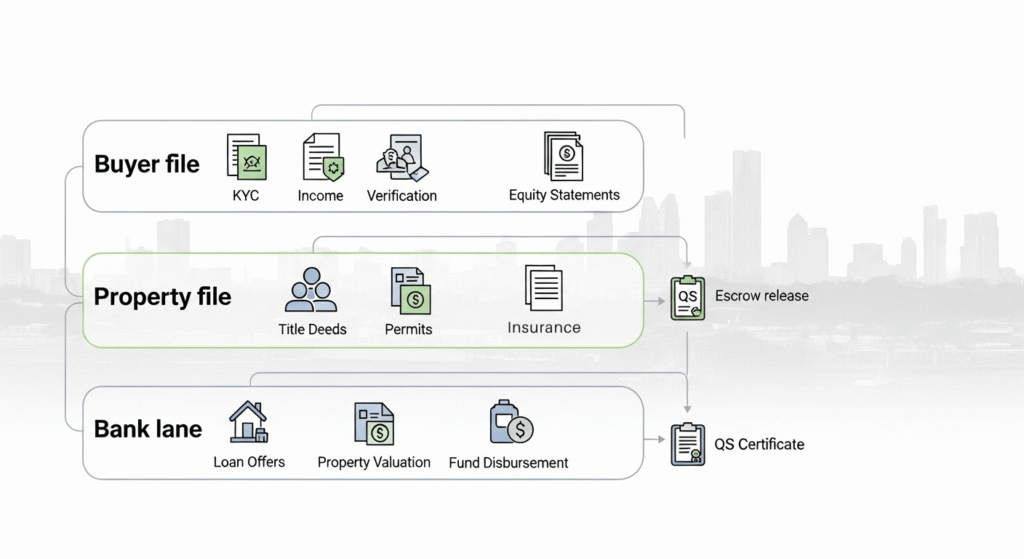

Collect what credit will ask for, at reservation

Pre-sales fail when documentation is an afterthought. Our reservation pack mirrors the bank’s checklist: KYC, employment letters or CAC documents, recent payslips or audited accounts, bank statements, pension statements where applicable, proof of equity, and a clear source-of-funds trail. On the property side, we provide title documents, survey and charting evidence, planning and building-control approvals, insurance notes, and a draft valuation template. When diaspora buyers are in scope, we add proof of residence abroad and income verification consistent with diaspora mortgage programs. This reduces “awaiting documents” bottlenecks and accelerates offer-to-approval timelines.

Design title for collateral

Underwriting is faster when the bank sees an enforceable security. For statutory grants, the chain is assembled and verified, consent history is shown where prior transfers exist, and governor’s consent for the new charge is built into the completion timetable. Within Eko Atlantic, we add developer recognition, estate technical clearances, and service-charge standing so the mortgage is recognisable from first draw. The closer the title pack is to “plug and play,” the fewer compliance queries you will face.

Test the grid before launch

We run sample borrower profiles through partner banks’ calculators and prequalification tools, then adjust list prices or unit mix to increase the share of buyers who pass on first attempt. A small adjustment in layout or pricing can convert marginal applicants into qualified homeowners, which raises absorption without discounting.

Building the finance rail: bank MOUs, progress-payment logic, and approval-to-disbursement discipline

A project absorbs when the finance rail is in place before launch. We start by locking a memorandum of understanding with partner banks that sets the underwriting box, documentation, valuation process, communication channels, and service timelines. The aim is to remove guesswork for buyers and reduce exceptions for credit officers.

Bank MOUs that do real work

The MOU should define maximum loan size, tenure bands by borrower age, equity thresholds, accepted income types, diaspora eligibility, panel valuers, turn times for offer letters, and escalation paths when files stall. It should also list the exact property documents that will be accepted for collateral, including title, survey, planning and building-control approvals, insurance notes, and, for Eko Atlantic assets, developer recognition and estate technical clearances. When these terms are codified, sales teams can guide buyers to the right unit at the right price, and mortgage officers can approve consistently.

Progress-payment logic that banks can fund

Disbursement should follow a simple, auditable sequence. We align the contractor’s programme with a stage schedule that a bank can verify: foundation to first slab, superstructure to roof, services rough-in, finishes to practical completion, and issuance of completion certificates. An independent QS certifies each stage, the escrow agent checks that conditions precedent are met, and the bank pays against objective evidence rather than narrative updates. This avoids liquidity gaps and protects both borrower and developer from timing disputes.

Approval to disbursement without slippage

Files move when buyer and property conditions are satisfied in parallel. Buyer conditions include KYC, income verification, equity proof, and any diaspora documentation where applicable. Property conditions include clean title and chain, valuation on panel terms, evidence of planning and building-control compliance, property insurance, and, where applicable, Eko Atlantic consents and estate no-objection letters. We also agree the order of funds: buyer equity lands first into escrow, bank funds follow on certification, and receipts are tagged to the unit file for audit. This discipline keeps offer-letter validity from expiring and reduces last-minute queries at disbursement.

Why this rail raises absorption

When eligibility, pricing, and documentation are aligned with bank policy, fewer applicants fail at credit, approval letters convert to funded loans, and handovers occur on schedule. The result is absorption that is measurable and bankable, not just a reservation tally.

From approval to keys: completion sequencing, default management, and handover controls

An approval letter is not a home; it is a countdown. Our job from that point is to remove timing risk so the mortgage funds within validity, the unit reaches practical completion on schedule, and possession transfers without dispute.

We run the buyer and property tracks in parallel. On the buyer side, we confirm equity has landed in escrow, refresh KYC and income documents where validity windows are short, and book valuation and offer-letter formalities with the bank’s panel. On the property side, we align the contractor’s programme with the bank’s disbursement logic, so stage certificates from the independent QS match clearly defined build milestones. Insurance is placed and noted, and any estate clearances required in Eko Atlantic are queued before the first draw. When both tracks are green, the bank disburses against objective evidence, not promises.

Practical completion is treated as a legal event. We issue a completion pack that includes the QS certificate, as-built drawings, utilities interface confirmations, and evidence that planning and building-control conditions are satisfied. In Lagos, that includes the pathway toward Certificate of Completion and Fitness for Habitation, which the authorities issue when statutory requirements are met. Before possession, we conduct joint snagging with a signed schedule, set a defects-liability period with response times, and document key handover items (access credentials, metering, warranties, service-charge onboarding). This creates a clean line between construction risk and occupancy.

Default management is engineered to preserve momentum. Offer letters have expiry dates; where a file risks stalling, we triage quickly: extend validity with updated documents, move the buyer to another partner bank if policy limits are the constraint, or convert to a bridged completion with tight sunset dates. If a buyer fails conditions after reservation, the contract specifies consequences—cure windows, liquidated damages, or reallocation to the waitlist—so inventory does not sit idle. Where the delay is on the developer side, we use completion guarantees, date-certain covenants, and, if necessary, temporary accommodation arrangements to avoid buyer prejudice. The objective is not zero problems; it is zero ambiguity about remedies.

At the handover meeting, we close the loop. Funds are confirmed, documents are executed, and possession passes with a signed protocol. The unit file now reads like an audit trail: equity receipts, bank disbursements tagged to milestones, valuation, title and consent artefacts, compliance evidence, snagging and rectification records, and the completion memo. Because the record is complete, the asset remains bankable for refinance and resales, and the buyer’s mortgage stands on enforceable ground.

Conclusion

Mortgage-backed absorption is a design problem, not an afterthought. When unit mix and pricing are built around real underwriting rules, when the finance rail is documented before launch, and when completion is treated as a legal event with objective milestones, pre-sales convert to funded handovers on schedule. That discipline does more than lift revenue recognition; it protects reputation with buyers and credibility with lenders, which, in turn, lowers the cost of capital on the next project.

Our operating cadence is consistent: align eligibility and documentation at reservation; codify bank policy in MOUs and stage-based disbursement; run buyer and property conditions in parallel; and treat practical completion, snagging, and possession as a single, auditable sequence. In Eko Atlantic, add estate recognition and technical clearances to keep the mortgage enforceable from first draw to discharge. The outcome is predictable occupancy, cleaner receivables, and assets that remain financeable across cycles.