Stakeholder Engagement for Lagos Prime Projects: Authorities, Utilities, and Eko Atlantic City

Introduction

In Lagos, you do not de-risk a project only in the legal room. You de-risk it in Alausa, at LASPPPA, at LASBCA, with the utility providers, and, for Eko Atlantic assets, with the city management team. Each one of those stakeholders controls something your buyers, lenders, and future tenants care about: planning approval, building certification, connection to power and water, service-charge standing, and in the case of Eko Atlantic, recognition of lender or buyer step-in. If one of them is skipped or engaged too late, a deal that looked perfect on paper can stall at connection or fail at financing.

Our approach treats stakeholder engagement as a parallel workstream to due diligence. We map the authorities and estate bodies that must see the project, identify what each of them tests (use, height, setbacks, technical compliance, utilities interface), and sequence applications so planning, building control, and estate approvals move in step. For Eko Atlantic, we add the free-zone layer: developer consent, technical no-objection, and service/utility alignment through the city’s portal, because the city actively manages infrastructure, waste, and power for occupiers.

This article explains how we keep projects in Ikoyi, Victoria Island, and Eko Atlantic “stakeholder clean”: how to engage LASPPPA for planning clarity, how to keep LASBCA in the loop so completion can be certified, how to work with utilities and estate managers on service-charge and connection issues, and how to align with Eko Atlantic City Management so both lenders and buyers see an asset that can actually operate.

Engaging regulators early: LASPPPA and LASBCA as project partners

Projects in Ikoyi, VI, and Eko Atlantic move faster when planning and building control are treated as co-authors, not gatekeepers. Lagos already tells us what it wants: apply for planning permit before you build, build what you applied for, invite the building-control agency to inspect, and collect a certificate at the end. If we engage that cycle at concept stage, we remove most of the friction.

Start with planning clarity (LASPPPA).

Before pricing land or promising a unit mix to investors, we obtain planning information and confirm the use, height, setbacks, and right-of-way constraints under the Lagos State Physical Planning Permit Regulations 2019. Where a change of use or extra floors are contemplated, we signal it early so the district office can tell us if it is admissible and what supporting studies or neighbor consents may be needed. Doing this first means our financial model rests on what Lagos can actually approve, not on a sketch.

Keep building control in the loop (LASBCA).

LASBCA’s job is to see that the building is safe, that the approved drawings are what is on ground, and that the project is fit for habitation. We schedule stage inspections, share contractor and consultant details, and capture every LASBCA endorsement so the file is complete when we ask for a Certificate of Completion and Fitness for Habitation. Buyers, tenants, and lenders now look for that certificate; skipping it only delays closure.

Use the electronic platforms.

Lagos now runs an e-planning and tracking portal for planning permits. We file through it, track status, and export receipts into the project data room. That visibility is useful when an overseas investor or bank wants to see where approvals stand without calling someone in Lagos.

Why this matters for negotiation and finance.

When we show a buyer or lender that (i) the use is lawful, (ii) building control is current, and (iii) completion can be certified, the asset stops looking speculative and starts looking bankable. It also reduces scope for last-minute discounts based on “unknown approvals.”

Utilities, service charges, and operational stakeholders

Picture a buyer who has paid, perfected, and taken keys, but can’t connect to power or water because the estate says the old owner is owing. That is how goodwill is lost. So we don’t leave operations for “after closing.” We diligence it like title.

First, find out who really runs the property.

In Ikoyi and VI, a lot of assets sit inside managed estates, condominium associations, or private infrastructure schemes. They issue access tags, run generators, handle waste, and collect service charge. We ask for their rules, current tariffs, arrears position, and transfer procedure. If you don’t get that early, your buyer will, and they will come back to renegotiate.

Then, reconcile money.

We request a statement of account from the estate or facility manager. Anything outstanding (service charge, diesel levy, sinking fund, special works) is listed in the contract and either cleared by the seller before completion or retained in escrow. We also confirm whether a transfer or introduction fee will be charged to the incoming owner, and if so, who is paying it. That one paragraph has saved more Lagos closings than any speech about “client service.”

Utilities are not all the same.

Public DISCO supply, IPP or estate power, private water, state water, private security, ISP, waste, and, for waterfront locations, shoreline or drainage maintenance. We map all of them and note who signs what. For estate power or IPP, we make sure the estate will recognise the incoming owner and that there is metering, not guess-billing. For waste and drainage, we confirm compliance with what the local council and LASBCA expect, so we don’t get a surprise notice after handover.

For Eko Atlantic, operations are part of title.

City management controls utilities interface, service-charge regime, road and promenade rules, even façade and signage standards. If the seller has arrears or has not obtained the right technical no-objection, the buyer will inherit it. We therefore ask the city to issue a standing statement: is the plot or building in good standing, will the city recognise the new owner and their lender, and are there any pending technical issues. We attach that to the deal room so lenders and investors see it with their own eyes.

Why we do it this way

Because operations is where buyer experience lives. If the access tag works, the lifts work, the generator comes on, the service-charge account is clean, and the city recognises the new owner, everything else feels professional.

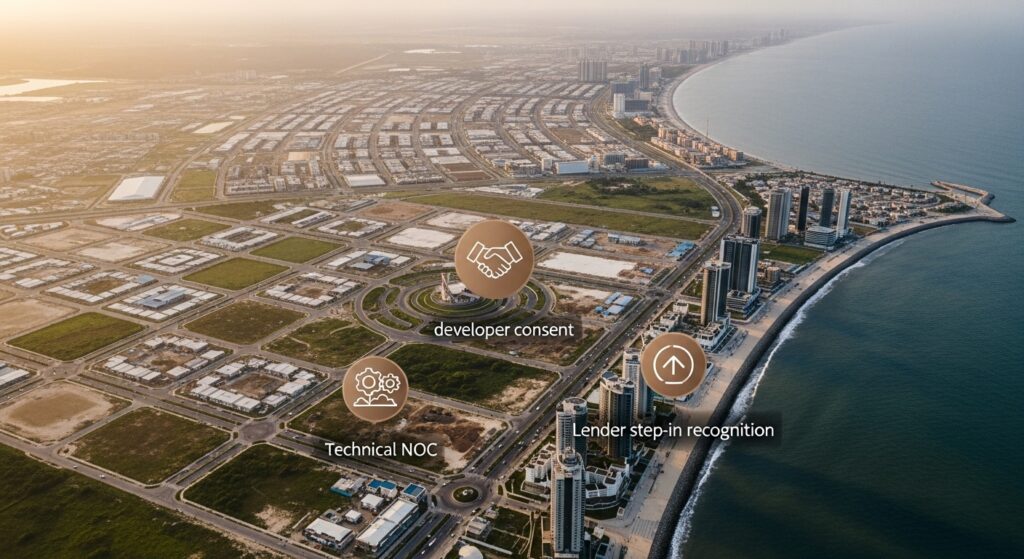

Eko Atlantic and estate-level alignment: consents, technical NOCs, and lender recognition

Eko Atlantic behaves like a city inside the city. You still need Lagos State to recognise your interest, but the estate also wants to see, approve, and sometimes co-sign the transaction. If we don’t line both up, financing gets delayed and occupiers can’t operate at full capacity.

Two signatures, not one.

For a plot allocation, sublease, or building interest inside Eko Atlantic, we ask two questions on day one: will the developer/city management consent to this transfer or charge, and will they recognise the incoming lender or buyer if enforcement ever happens. We don’t wait until completion to ask. We put the forms in, get the consent fees and technical requirements, and table them in the SPA so both parties know what it costs.

Technical NOCs are as important as title.

The city cares about design, utilities interface, connection to the promenade and roads, fire and life-safety, and estate services. We make sure those NOCs are current and transferable. If a buyer intends to upgrade the building or change use, we get a “no objection in principle” so the buyer does not have to renegotiate from scratch. That single document often decides whether a bank will disburse.

Service-charge and operations clearance.

Eko Atlantic runs a structured service-charge regime. We request a statement, we confirm no arrears, and we get a letter that the city will recognise the new owner/occupier. If arrears exist, we settle or escrow them. That way, connection to power, water, and other services is automatic on handover.

Lender recognition.

Because many of your buyers and JV partners borrow, we secure a recognition/step-in letter from the city. It says, in substance, “if this borrower defaults and the bank enforces, we will recognise the bank as successor and keep services running.” Lenders love this because it makes their security real. We staple that letter to the title pack.

Why this matters beyond Eko Atlantic

The same pattern shows up in Oniru, gated Ikoyi courts, and some VI estates. Once an estate provides infrastructure, it wants to know and approve who comes in, who connects, and who pays. Bringing the estate into the documentation early stops them from blocking you later.

Conclusion

Stakeholder engagement is the part of Lagos real estate that looks soft but decides whether a project will actually work. When LASPPPA has seen the scheme, LASBCA has inspected the structure, the estate or facility manager has cleared service charges, and Eko Atlantic (or any other city-level manager) has issued its consents and NOCs, the asset becomes operational, financeable, and sellable. When any of those are missing, the same asset becomes a negotiation exercise at every step.

Our method is simple. Map every authority and estate that can say “no.” Engage them in parallel with legal and financial diligence. Put their approvals, receipts, and statements of account in the data room. Tie payment and completion to these deliverables. That rhythm gives comfort to UHNW buyers, to family offices, and to institutions, because it shows the project is not just a land or building story, but an operating Lagos asset.