Lagos Real Estate is Broken — Ronald Igbinoba on the Truth Behind the Crisis

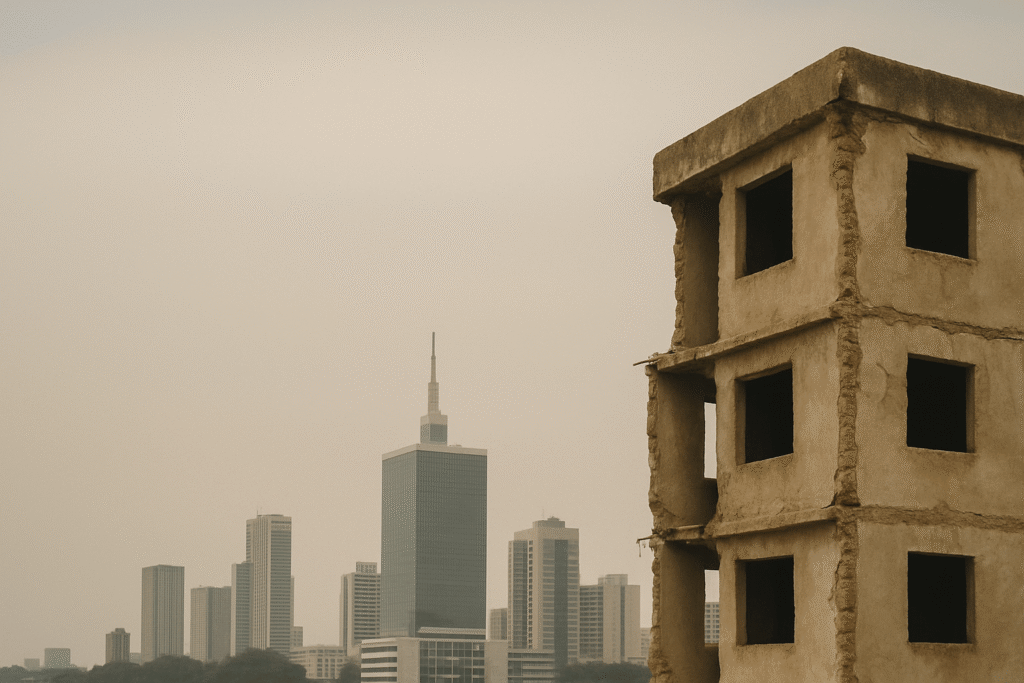

The illusion of luxury is collapsing in Lagos

For years, Lekki Phase 1 and similar districts have been marketed as elite enclaves for Nigeria’s upwardly mobile. But as real estate analyst and development expert Ronald Igbinoba explains in this sharp, data-backed episode of The Coffee Table with Ugodre, the reality tells a much harsher story.

According to Igbinoba, Lagos is not just experiencing a market correction — it’s in the middle of a systemic affordability crisis. Over 87% of Nigerians are effectively priced out of homeownership, while less than 5% of properties in Lagos fall below ₦15 million, the informal affordability ceiling for low- to middle-income earners.

And the problems go deeper than pricing.

What appears to be a booming property market is actually being inflated by speculative development, short-let distortions, and profit-first models that ignore the fundamental housing needs of the population. From skewed GDP figures to unsustainable rent spikes and questionable government interventions, the Lagos housing narrative is far from balanced.

In this article, we unpack the harsh realities of the Lagos real estate market as laid out by Ronald Igbinoba — and why any serious investor, developer, or policymaker must stop believing the hype.

The Mirage of Luxury — Why Lekki Is No Longer Premium

Once considered the apex of Lagos urban living, Lekki Phase 1 has, in recent years, undergone a quiet reclassification — not by government decree, but by market dynamics and lived realities.

According to Ronald Igbinoba, the problem isn’t merely that Lekki has lost its sheen. It’s that the label “luxury” no longer aligns with the infrastructure, pricing, or housing stock in the area. On paper, Lekki remains a high-value district. In practice, it’s becoming overcrowded, overpriced, and, in some areas, poorly maintained.

Key Issues Devaluing Lekki’s Luxury Status:

- Over-Supply of Generic Units

Developers have saturated the area with copy-paste 4-bedroom terrace duplexes, many of which lack architectural originality, spatial planning, or quality finishing. These properties are priced as luxury, but do not deliver in terms of design, experience, or longevity. - Infrastructure Deficit

Power supply, drainage, traffic management, and road quality continue to lag far behind the pricing of properties. In some areas, water treatment is non-existent, and security is decentralized and ineffective. - Speculative Development Culture

Real estate in Lekki has largely been driven by investor expectations rather than end-user needs. This has resulted in the construction of properties that are unaffordable for most Nigerians and unsuitable for actual occupancy. - Lifestyle Decline

What should be a premium residential zone is gradually turning into a transient, short-let-heavy area. As a result, community-building, long-term residence, and social stability are in decline.

“Lekki is no longer a luxury market — it’s a volume market. The margins are still high for developers, but the value proposition to end users is questionable.”

— Ronald Igbinoba

In short, Lekki still commands luxury prices but no longer offers luxury value. It’s an emblem of a broader problem in the Lagos property ecosystem: price inflation without corresponding quality or liveability.

Locked Out — Why 87% of Nigerians Can’t Afford a Home

The Nigerian dream of homeownership is slipping further out of reach. Ronald Igbinoba points to a stark figure: 87% of Nigerians are locked out of the housing market. That’s not a rhetorical flourish — it’s an empirical reality drawn from national housing data, income benchmarks, and pricing trends in Lagos and beyond.

This exclusion isn’t due to a shortage of housing units alone. It’s a structural failure that spans policy, financing, development priorities, and economic inequality.

The Four Barriers to Entry:

- Pricing vs. Income Gap

The median Nigerian earns far below what is required to service a mortgage or pay upfront for even the lowest-priced urban properties. With less than 5% of homes in Lagos priced below ₦15 million, access is reserved for a narrow elite. - Absence of Accessible Mortgage Finance

Nigeria’s mortgage penetration is under 1%. Most Nigerians lack formal credit histories, stable income, or collateral — all prerequisites for home financing. Interest rates remain prohibitive, and tenures are often too short to be affordable. - Land Use Act and Title Bureaucracy

The Land Use Act of 1978 centralizes land ownership under state governors. This creates a bottleneck for private development and makes the acquisition of Certificates of Occupancy (C of Os) time-consuming, expensive, and uncertain. - Overemphasis on High-Yield Projects

Developers, in the absence of incentives to build for the middle or lower class, focus on projects with higher profit margins. These are often in the short-let or luxury bracket, leaving real residential demand unmet.

Consequences of the Housing Gap:

- The housing deficit in Nigeria exceeds 3.4 million units, according to recent estimates.

- Rent continues to rise, especially in urban centers like Lagos, as demand outpaces supply in the affordable bracket.

- Young professionals and families are increasingly pushed into multi-tenant and informal housing arrangements, or forced to live far from job centers.

The bottom line: Without decisive policy intervention and private sector restructuring, homeownership in Lagos — and Nigeria at large — will remain a privilege for the few.

“It’s not just a housing crisis. It’s a social inequality crisis. The market is working, but it’s not working for the people.”

— Ronald Igbinoba

The Short-let Effect — When Airbnb Drives Up Rent

In Lagos, the rise of the short-let market has introduced a new layer of complexity to an already fragile housing economy. What began as an innovative alternative for hospitality has now morphed into a distorting force in the residential rental market, pushing rents beyond what most working-class Nigerians can afford.

Ronald Igbinoba refers to this as the “Airbnbfication” of urban housing — a phenomenon where properties meant for long-term living are diverted into high-yield, short-term rentals.

How Short-lets Inflate Housing Costs:

- Landlords Exit the Traditional Rental Market

Many property owners now prefer leasing their units on a daily or weekly basis through platforms like Airbnb or booking agents. This shift reduces the stock available for long-term rent and increases competition (and prices) for what’s left. - Revenue Potential Skews Developer Strategy

Developers are tailoring more projects toward short-let investors, not homeowners or long-term tenants. As a result, you get buildings optimized for aesthetics and turnover, not quality of life or affordability. - Communities Turn Into Hotels

Areas once known for stable residential life — like Lekki and Victoria Island — are now filled with transient populations. This undermines social cohesion, affects local security, and can create friction between short-let operators and permanent residents. - Pricing Model Misalignment

In some parts of Lagos, rental income from short-lets outpaces annual residential rents within a single quarter. Naturally, this compels landlords to prioritize short-let models — leaving the conventional tenant outbid and displaced.

Regulatory Blind Spot

Despite its growth, the short-let sector remains largely unregulated. There are no zoning laws, licensing frameworks, or enforceable standards guiding the industry. This vacuum allows unchecked expansion, even in areas where it may be unsuitable or disruptive.

“Short-lets have become a proxy for quick capital recovery — but at what social cost?”

— Ronald Igbinoba

Until clear policies are introduced to manage the balance between hospitality-driven profit and residential needs, short-let proliferation will continue to cannibalize Lagos’s rental housing market.

Affordable Housing Is a Myth — The Real Cost of Land in Lagos

The term “affordable housing” is often thrown around by politicians, developers, and marketers — but according to Ronald Igbinoba, it’s little more than a rhetorical gimmick in Lagos. When examined against the actual cost of land, construction inputs, and urban infrastructure gaps, the idea of affordability collapses under scrutiny.

At the heart of the problem is land — and Lagos, as a coastal megacity with intense spatial constraints, is one of the most expensive markets in sub-Saharan Africa.

Why Affordable Housing Doesn’t Work in Lagos:

- Land Pricing Is Prohibitively High

In core urban zones like Ikoyi, Lekki, Victoria Island, and even emerging corridors like Sangotedo, land prices have escalated beyond rational limits, often pegged to speculative benchmarks rather than real demand. As Ronald points out, “If the land is expensive, the housing can’t be cheap. It’s that simple.” - High Infrastructure Loading

Developers are often responsible for providing basic infrastructure — roads, drainage, water systems, even electricity. These costs are typically passed on to buyers, further bloating sale prices and pushing “affordable” out of range for the average Nigerian. - Inefficiencies in Land Titling and Approvals

Land ownership in Lagos is entangled in bureaucracy. Acquiring a clean title, governor’s consent, or necessary development permits can take months — or years. This delay raises holding costs and legal risks, which developers bake into the final price. - Disconnection from Income Reality

There is a fundamental mismatch between the pricing of so-called affordable housing and the earning power of 70–80% of urban residents. Even ₦12–15 million homes — when they exist — are accessible only to a tiny professional elite or diaspora buyers.

The “Affordable Housing” Label Is Often Just Marketing

What gets sold as affordable housing is often a micro-flat in a fringe location, with minimal amenities, poor accessibility, and zero communal infrastructure. These units are typically not livable or bankable in the long term. In truth, they are low-cost, not affordable — and the two are not the same.

“We must separate affordability from low quality. One is an economic goal; the other is a structural compromise.”

— Ronald Igbinoba

Until land reform, infrastructure investment, and development policy are aligned with real income demographics, the phrase “affordable housing” will remain a political tool, not a practical solution.

What Can Be Done? Real Solutions for a Broken Market

Ronald Igbinoba doesn’t just diagnose the rot in the Lagos housing market — he outlines clear, actionable steps for both government and private sector actors to shift the system toward inclusion, sustainability, and real value.

Fixing the problem will require structural, financial, legal, and regulatory reforms. And it must begin with a shift in development philosophy — from profit-led to people-focused.

Key Solutions Proposed by Igbinoba:

1. Land Reform and Title Efficiency

The current process for acquiring land and registering title documents is opaque, expensive, and time-consuming. Ronald advocates for:

- Digitization of land records

- Decentralization of land registry functions

- Time-bound approval frameworks

This will reduce corruption, lower transaction costs, and make land acquisition easier for legitimate developers focused on affordable housing.

2. Incentivize True Affordable Housing

Instead of rhetorical commitments, government must offer tax breaks, fast-track permits, and infrastructure subsidies to developers who commit to delivering homes under ₦15 million. These incentives should be conditional, measurable, and legally enforceable.

3. Regulate the Short-let Market

Short-let developments must be brought under formal zoning, licensing, and taxation. This helps strike a balance between hospitality innovation and residential stability. Key measures include:

- Defining short-let zones

- Issuing operator licenses

- Mandating local compliance and tax reporting

4. Expand Mortgage Access and Affordability

Nigeria needs a functional mortgage system for the bottom 70% of the population. Ronald suggests a multi-pronged approach:

- Strengthen the National Housing Fund (NHF)

- Improve credit profiling and data systems

- Encourage public-private mortgage partnerships

- Cap interest rates for low-income borrowers

5. Public-Private Partnerships for Rental Housing

Not everyone needs to own a home — and that’s okay. A thriving rental market can fill the housing gap if properly structured. Government and institutional investors can:

- Build rental estates managed under trust

- Peg rents to inflation-adjusted income bands

- Use build-to-rent models as long-term public housing policy

Legal and Policy Implication:

These solutions are not just market strategies — they require legislative backing, executive coordination, and judicial protection. Without a formal real estate regulatory commission, housing policy in Nigeria remains fragmented and reactive.

“The market alone cannot fix housing. It has to be a coordinated effort between law, capital, and conscience.”

— Ronald Igbinoba

The Future of Lagos Housing — Innovation, Blockchain & the New Frontiers

Despite the current housing crisis, Ronald Igbinoba is not without optimism. In fact, he believes the Nigerian real estate market is on the verge of a digital evolution — one driven by innovation, decentralization, and alternative financing models.

From blockchain-based transactions to PropTech solutions and new forms of real estate tokenization, the future of housing in Lagos might look very different from its past — if key stakeholders embrace technological transformation.

Emerging Trends and Innovations:

1. Blockchain for Land Registry and Property Transactions

- Lagos real estate remains vulnerable to title fraud, double allocations, and lack of traceability.

- Blockchain technology can create immutable, transparent property records and enable faster, more secure transactions.

- Countries like Georgia and Sweden have already piloted blockchain land registries with success — Nigeria can do the same.

2. Real Estate Tokenization

- Tokenization involves dividing real estate assets into digital shares (tokens) that can be sold to multiple investors.

- This opens the market to fractional ownership, allowing middle-income Nigerians and diaspora investors to own portions of high-value assets.

- It also boosts liquidity and democratizes capital access.

3. PropTech Platforms and Data Analytics

- Data is critical for smarter, more demand-driven development.

- PropTech firms in Nigeria are beginning to leverage AI and big data to:

- Map pricing trends

- Predict demand hotspots

- Optimize site selection and project feasibility

- This enables evidence-based development, rather than the speculative models that dominate today.

4. Smart Construction Methods

- Technologies like 3D printing, modular construction, and AI-assisted design offer cheaper, faster, and more scalable solutions for housing development.

- These innovations can reduce costs by up to 30–40% without compromising on durability or design.

The Policy & Legal Consideration

While these technologies are promising, Nigeria’s legal and regulatory systems must evolve to accommodate them. That includes:

- Updating the Land Use Act to enable digitized and blockchain-compatible registries

- Creating frameworks for tokenized asset regulation

- Encouraging sandbox testing environments for PropTech startups

- Institutionalizing data privacy, investor protection, and smart contracts

“Innovation without regulation is chaos. But regulation without innovation is paralysis.”

— Ronald Igbinoba

The Lagos of tomorrow won’t be built with concrete alone — it will be built on code, policy, and capital alignment.

Conclusion — Lagos Housing Needs a Reset, Not Just a Rebrand

The Lagos housing market doesn’t need another glossy brochure, grand launch, or political ribbon-cutting. It needs a complete systems reset — one that redefines success not by skyline aesthetics or developer profits, but by accessibility, sustainability, and equity.

As Ronald Igbinoba makes clear in this episode of The Coffee Table, the crisis in Lagos is not about supply alone. It’s about the misalignment of purpose, policy, and profit. From Lekki’s fading appeal to the artificial price inflation driven by short-let strategies, every layer of the market is failing the demographic it should serve the most: everyday Lagosians.

What This Means for Stakeholders:

- Investors must recalibrate their metrics beyond yield and capital appreciation. True value will increasingly be measured by market resilience and long-term demand, not just exit multiples.

- Developers should resist the temptation to chase fads and instead build with a ground-up understanding of what the city and its people actually need.

- Government actors must move from policy announcements to legislated action, backed by enforceable timelines, data transparency, and genuine private sector collaboration.

- Young Nigerians, the most affected demographic, should not just consume housing — they must shape the conversation, demand reform, and explore innovative models like cooperative housing, community land trusts, and tech-enabled investing.

Final Thought:

The Lagos real estate market doesn’t need to collapse to evolve. But if it continues on its current path — detached from affordability, overexposed to speculation, and governed by outdated laws — it may soon price itself out of its own future.

“We need a housing revolution in Nigeria. Not in design, but in intention.”

— Ronald Igbinoba