Capital Raising in Lagos: How We Engage UHNW, Family Offices, and Institutions

Introduction

Raising capital for prime Lagos assets is not a roadshow; it is a sequence. Serious money wants clarity on mandate, certainty on title and governance, and confidence that execution risk is controlled from land to handover. Our role is to engineer those conditions, then match the right opportunity to the right pocket of capital — UHNW, family offices, or institutions — with terms that reflect risk, control, and timelines.

We start by defining the investment mandate in plain terms: asset type, location, use, target returns, risk limits, and exit paths. That mandate is then matched to the investor’s profile. UHNW investors often prioritise access, co-investment rights, and reporting that is direct and frequent. Family offices look for tax efficiency, capital protection, and succession-friendly structures. Institutions require committee-grade governance, covenant testing, and a repeatable reporting cadence. In every case, we design the vehicle and documentation to make the offer bankable: a clean SPV, clear decision rights, escrowed flows, audit-ready data, and a timetable that respects due diligence.

Investor relations is a discipline, not an email blast. We maintain a data room built around primary evidence: chain of title and surveys, planning and building-control approvals, Eko Atlantic estate recognitions where relevant, QS budgets and programmes, valuation approaches, and draft legal instruments. Updates are scheduled, variances are explained, and risks are quantified with mitigants. By the time capital commits, there are no surprises — only choices about allocation and timing.

This article sets out how we raise and steward capital for Lagos projects: how we design the raise so it fits UHNW, family office, and institutional expectations; how we run investor relations so committees can underwrite without friction; and how we close capital with documents, controls, and drawdown mechanics that protect every party.

Designing the raise (mandate, vehicle, and terms that fit UHNW, family offices, and institutions)

We begin with a precise mandate and design the raise around it. The mandate is a single page that an investment committee can read without a glossary: asset type and location (Eko Atlantic, Ikoyi, VI), use case (residential, mixed-use, income vs development), target returns with downside limits, timetable to liquidity, and the control architecture (board rights, veto thresholds, step-in mechanics). Everything else flows from this sheet.

Choose the right vehicle, then hard-wire governance. For single-asset transactions, a Nigerian SPV limited by shares keeps liability ring-fenced and bankable. For development inside Eko Atlantic, we add an estate-recognised entity and mirror consents in the SPV’s constitution. Where cross-border investors participate, we may pair the Nigerian project company with a feeder or holding structure that simplifies subscriptions, FX, and tax reporting. Governance is embedded, not implied: reserved matters (scope changes, budgets, leverage, disposals), information rights (monthly packs, QS certification, covenant dashboards), and cure/step-in provisions that preserve momentum if a counterparty misses targets.

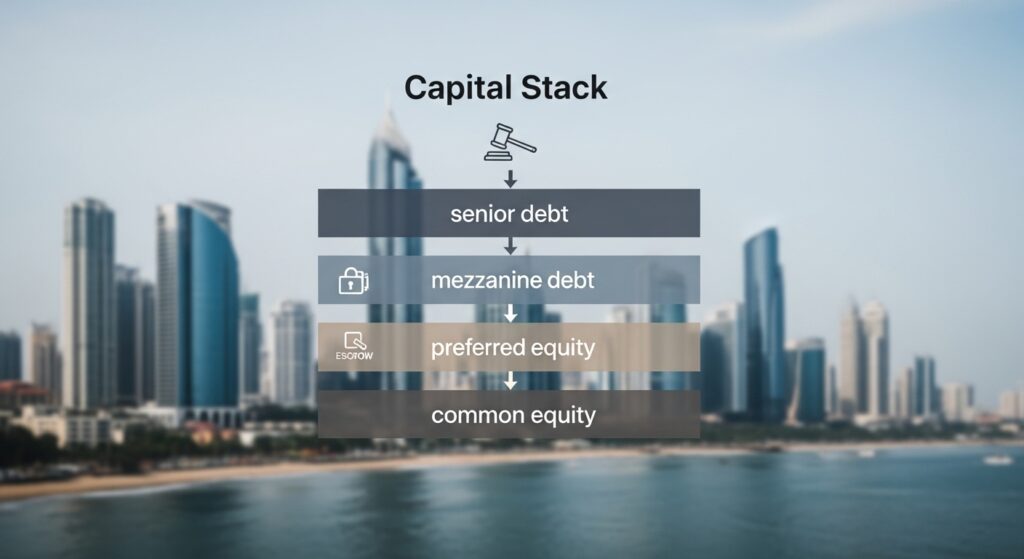

Term the capital to the risk. Development equity should not pretend to be income equity. We align instrument to risk layer: common equity with promote tiers for genuine development risk; preferred equity for de-risked phases with priority distributions and hard covenants; mezzanine only where cash flows can support it and intercreditor terms are clear. Waterfalls are simple and auditable: return of capital, preferred return, catch-up, then residual split. FX is addressed up front (currency of account, settlement, hedging windows, and what happens if banks restrict access).

Tailor terms to the investor profile.

- UHNW investors value access and control. We keep structures clean, offer co-investment on larger tickets, give look-through reporting, and set clear vetoes over headline risks (leverage, scope, related-party contracts). Liquidity options are time-boxed windows or orderly transfers with pre-emption, not open-ended redemption promises.

- Family offices optimise for capital protection and succession. We emphasise priority distributions, escrowed flows, and trustee-friendly documentation; add tax and currency planning; and limit key-man risk through board composition and succession clauses.

- Institutions underwrite process. They require a repeatable reporting cadence, Big-4 audits, ESG and sanctions compliance, RICS/IVS valuations, lender-grade covenants, and a documented route to enforcement (step-in, recognition agreements, intercreditor). We stage capital with objective milestones (title/perfection, permits, QS progress, presales quality) so drawdowns mirror de-risking.

Price the raise with evidence, not aspiration. Target returns sit on three legs: replacement cost with contingency, verified comps showing real absorption, and a finance model that survives sensitivity runs on rate, FX, programme, and sales velocity. We publish both the base case and the “bank case” so expectations are aligned before first subscription.

Investor relations that convert (materials, data-room discipline, reporting cadence)

Materials that answer committee questions before they’re asked

We build the raise around primary evidence, not marketing prose. The core pack includes: a one-page mandate; SPV constitution and cap table; governance summary (board, reserved matters, veto thresholds); title chain with Certified True Copies, survey and charting note, consent/perfection status; planning and building-control approvals; for Eko Atlantic, estate recognitions and technical NOCs. On delivery risk: QS budget and programme, contractor credentials, performance bonds/PCGs, insurance schedule. On value and returns: RICS-standard valuation approach, comp set with absorption notes, finance model with sensitivities (rates, FX, cost creep, timeline, sales velocity), and a risk register with quantified mitigants. Add draft legal instruments (SHA, escrow and waterfall, recognition and intercreditor), tax/FX memo, and a compliance statement (KYC/AML, sanctions, data protection). The point is to let an IC move from “what is this?” to “how do we allocate?” in one sitting.

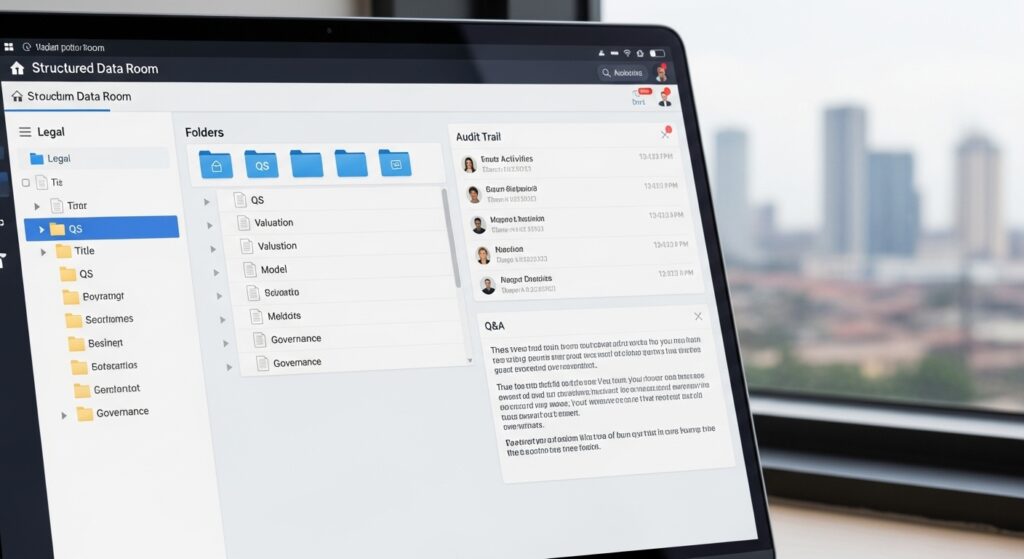

Data-room discipline that builds trust

We run a tiered VDR with audit trails and strict permissioning. Tier 1 holds the mandate, teaser, and high-level numbers after NDA. Tier 2 opens on verified interest and proof of funds, exposing title/permit artefacts, QS packs, model, and draft documents. Every file is named to a convention, watermarked, and version-controlled; redlines sit next to cleans so reviewers see change history. A single Q&A board replaces side emails; answers are timestamped and, where relevant, supported by documents added to the room. A weekly “release note” summarises what changed (drawings updated, model vX→vY, consent receipt uploaded) to stop version drift. Access windows are time-boxed; dormant seats are recycled to avoid leak risk.

Reporting cadence that converts interest to commitments

We keep the rhythm predictable and brief. A weekly two-page update covers RAG status, milestones hit (e.g., survey charting, consent filing, estate NOC), variances against plan, and next-week objectives. A fortnightly investor call (agenda sent 24 hours prior) walks through the same dashboard with one deep-dive (title, QS, finance model, or sales). Monthly, we publish a compact data-room snapshot (files added/retired, key clarifications, open actions). All numbers reconcile to source documents in the VDR. For institutions and family offices, we offer an LPAC-style clinic once per month to settle technical questions with counsel, QS, and the modelling lead present. Tone is factual: what changed, why it changed, and how the risk is now controlled.

From soft interest to signed tickets

We map each investor’s internal path to “yes” and stage the close accordingly: credit or IC date, required third-party opinions, model sign-off, ESG confirmations, and any board approvals. Subscription documents are pre-populated; KYC/AML and sanctions checks begin when term sheets are issued, not at the last minute. Drawdown mechanics (escrow conditions, milestone schedule, reporting calendar) are annexed to the subscription so legal and finance teams know exactly how cash moves. The close call is procedural because the groundwork is already visible in the room.

Why this works

Committees move when evidence is verifiable, change is documented, and the update cycle is quiet, short, and complete. Good investor relations is not volume; it is signal backed by documents an auditor would accept.

Closing capital (due diligence, KYC/AML, documentation, escrow, and drawdowns)

A good raise ends with a procedural close. We assign owners to each workstream, lock a single timetable from investment committee sign-off to first draw, and freeze the data room so every number used at signing is the same one used at funding.

Confirmatory due diligence

We keep it short and conclusive. Legal counsel issues a red-flag memo on title, chain, consents, litigation exposure, corporate authorities, and enforceability of the investment documents. Technical advisers (QS and engineers) validate cost to complete, programme logic, long-lead items, and contractor capacity. Finance signs a reliance pack: model with sensitivities, valuation basis, tax and FX notes. Each adviser tables a one-page sign-off; exceptions become dated conditions precedent.

KYC/AML and sanctions screening

We start KYC when term sheets go out, not at the end. For entities, we collect incorporation documents, registers of shareholders and persons with significant control, beneficial-owner declarations, board resolutions, and bank references. For individuals, we verify identity, address, source of funds, and income or liquidity. All counterparties are screened for PEP status, sanctions, adverse media, and conflicts. Where trusts or layered SPVs are involved, we drill down to natural persons and obtain trustee certifications. Files are stored with audit trails and access controls to meet data-protection requirements.

Documentation that carries the capital

The subscription agreement, shareholders’ agreement, and any side letters are harmonised with the SPV constitution. The escrow deed and collections/accounts agreement codify how money moves, in what order, and on which evidence. Intercreditor and recognition agreements align lender rights with sponsor cure and step-in. For Eko Atlantic assets, developer consents and estate technical no-objection letters are annexed so committee reliance is explicit. The CP/CS schedule is the close: it lists what must be in hand before cash moves (consent filings, stamping adjudication, survey charting, insurance binders, QS certificates, service-charge standing) and what must arrive within fixed windows after funding (registration receipts, consent letters, updated folios).

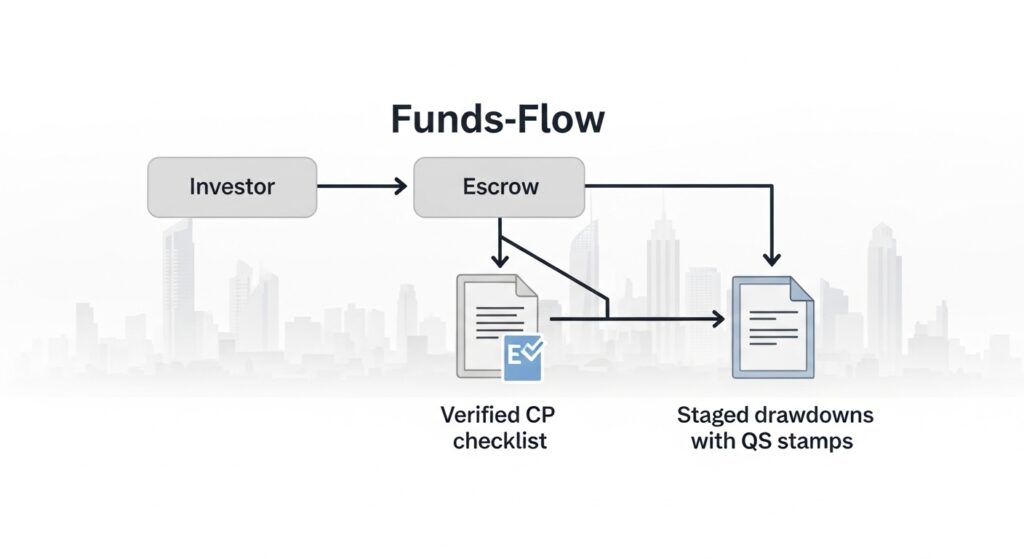

Escrow and funds flow

We open accounts with a Tier-1 bank and test the rails before signing. Equity lands first and is ring-fenced until CPs clear. Release conditions are objective: duty assessments paid, applications lodged, certificates issued, and no-objection letters uploaded to the locked data room. Each disbursement is tagged to a unit or work package; the escrow agent acts only on the checklist and publishes a brief release note so the audit trail is continuous. Where FX is involved, conversions, hedging windows, and settlement mechanics are recorded in the deed.

Drawdowns that mirror de-risking

Funding follows milestones the bank can verify. We align contractor programme stages with QS certification: substructure, superstructure, services, finishes, practical completion. Equity covers early packages and contingencies; senior debt or preferred equity draws when objective progress is demonstrated. After each draw, the borrower issues a short variance memo and a refreshed 13-week cash forecast; the lender updates covenant dashboards (DSCR/ICR where relevant, liquidity, cost-to-complete). Longstop dates and material-adverse-change provisions are narrow and factual to avoid ambiguity.

Why this closes cleanly

Evidence is locked in one room, CPs are written against documents not promises, escrow only releases on objective checks, and every naira is traceable from subscription to use of proceeds. That is what turns soft commitments into cash on schedule.

Conclusion

Capital raises succeed when structure, evidence, and rhythm are clear. A precise mandate and a vehicle with hard-wired governance give investors confidence about control. A disciplined investor-relations pack, built on primary documents and a clean data room, answers committee questions before they are asked. A procedural close, with KYC, escrow, and milestone drawdowns, turns signed term sheets into cash on schedule.

For UHNW and family offices, this reduces noise and protects downside. For institutions, it creates a repeatable framework that is easy to underwrite and monitor. In Lagos, and especially inside Eko Atlantic, adding estate recognitions and technical approvals to the standing exhibits keeps the security enforceable from first subscription to final exit.

Our rule is simple: design for bankability first, then market the opportunity.